HODL. It’s a word that you will hear all over the Bitcoin space. You will see it on Twitter, Reddit, and other social media platforms but how can I take that mantra and build a case study around it? I decided that I would buy some bitcoin and HODL for as long as I can and build some data around the pros and cons of hodling. The word “HODL” was born from a misspelling of the word “hold” in a bitcoin forum to encourage users to just hold onto their bitcoin and not panic sell when the price was dumping.

HODL is now commonly used as the acronym, Hold On for Dear Life but it makes Bitcoin sound weak so I am trying to get another one to catch on. I prefer Hard money, On-Chain, Don’t sell, Long Term.

I decided to put this motto to the test by creating a simple case study where I buy a small amount of bitcoin and do as us bitcoiners do and just …HODL.

Before we get into the details of this study, please take a moment to read my disclaimer and disclosure. It goes into detail on how none of this is financial advice and that bitcoin is risky. It also covers how I generate revenue with the use of affiliate links and a single banner ad on each study.

Here’s what the ad looks like.

Now let’s look at how easy it is to HODL.

Case Study Parameters

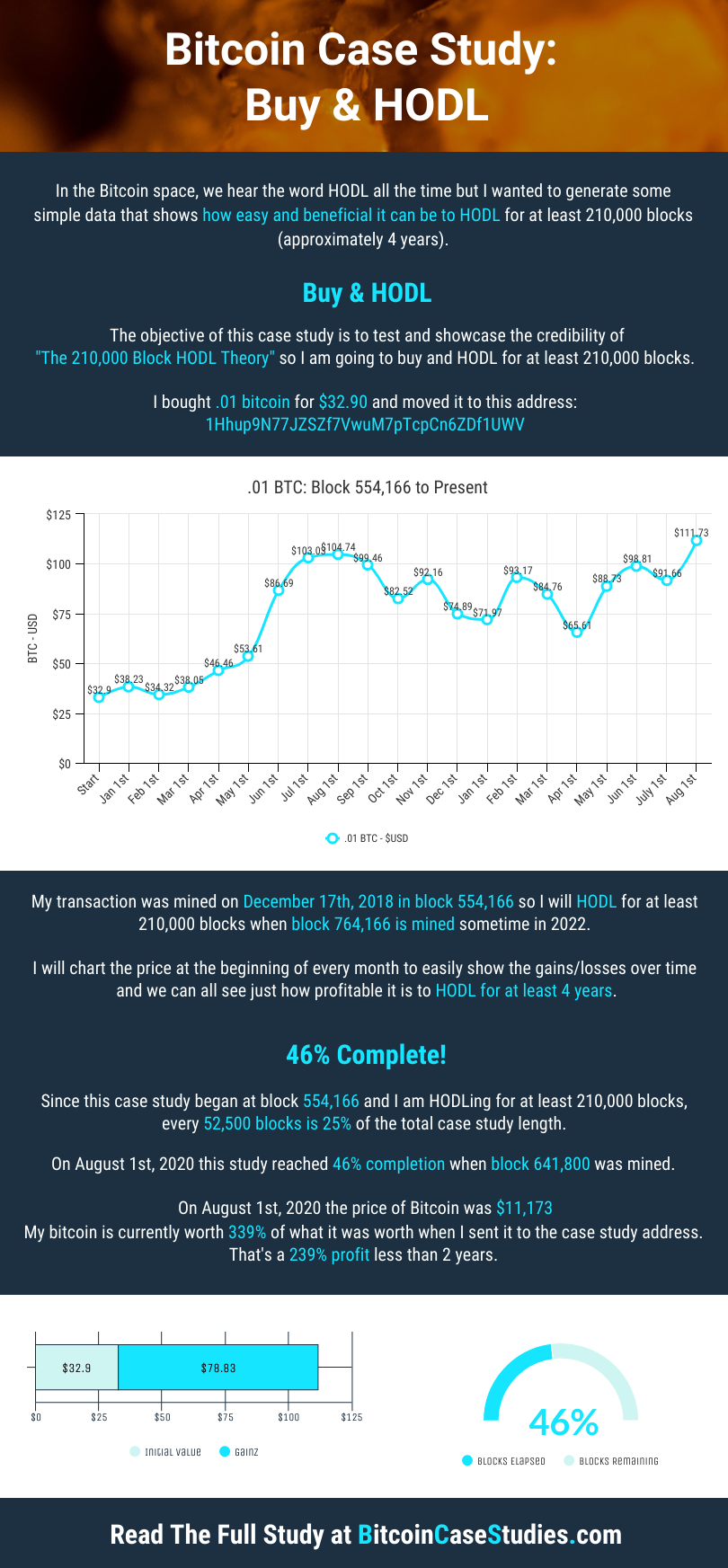

This study is simple. I bought some bitcoin and am going to hodl it for 210,000 blocks (approximately 4 years). I just want to see my profit/loss for a few years to track the ups and down over time. I will publish the results for the whole world to learn from and see if HODLing is a good idea or not.

I sent to the case study address in block 554166 and (ideally) I will be hodling until block 764166 which will be mined sometime in 2022.

Entry Strategy

I spent about $350 to buy .1 Bitcoin (BTC) using a service that I no longer use (now I use Cash App) and moved it to my KeepKey so I can do some experimenting with it. I waited for the market price to dip as low as I thought it would go on the day that I began this study and then I made my purchase.

I sent .01 Bitcoin (BTC) to an address for the duration of the study. I will call this the case study address, seen here:

1Hhup9N77JZSZf7VwuM7pTcpCn6ZDf1UWV

Exit Strategy

My exit strategy is to HODL for at least 210,000 blocks. This is what I would consider a mid-term hodl since it guarantees at least one block reward halvening. I will take note of its valuation on the first of every month and publish its performance over time. I may sell it if the price increases enough but am most interested to see how it will perform over the course of the next 4 years.

I chose this exit strategy because every single bitcoin that has ever been mined or transacted has a much higher valuation 210,000 blocks after it was mined or transacted and I want to see how long that will be true. It’s possible that it will NOT be true by the end of this case study.

Profit & Loss

I will be using the USD price from the Blockchain.com block explorer as my starting price. I will be using Cash App to pull the daily low price on the 1st day of the month to update as time goes on.

When you view the case study address on the block explorer, Blockchain.com, you can see the amount of bitcoin in the little green box toward the lower right-hand corner of the page. When you click on that box, it changes between the USD valuation and the BTC valuation.

When I started this case study, Blockchain had a different interface that allowed you to see the fiat valuation of a UTXO just by hovering your mouse over the amount but they have since updated the site and removed this feature. When I started this study, my .01 Bitcoin (BTC) was valued at $32.90 so I will be using that number to track the rises and falls of my HODL over time.

If all of this sounds overwhelming, don’t worry. I publish all of the data from every study in an easy to understand infographic and my Bitcoin Case Studies Spreadsheet for those who are more interested in an actual spreadsheet to view the data.

Infographic: Buy & HODL Bitcoin

None of my case studies would be complete without some sort of easy-to-understand visual representation of the data that’s been collected so far. Here’s what my first case study looks like in an infographic.

Thank You

Thanks for taking the time to read this case study. If you have any questions, comments, or concerns, please don’t hesitate to reach out to me on KeyBase.

Also, if you would like to help me take a set toward working full-time on bitcoin projects like this one as well as help me get even more data points for my study on earning bitcoin with Tippin.Me, please consider sending an LN tip my way.

I will see you all on the moon citadel,

– Jon